The Thomas Insurance Advisors PDFs

Wiki Article

Thomas Insurance Advisors for Beginners

Table of ContentsThe Facts About Thomas Insurance Advisors UncoveredOur Thomas Insurance Advisors IdeasOur Thomas Insurance Advisors IdeasWhat Does Thomas Insurance Advisors Mean?Thomas Insurance Advisors - Questions

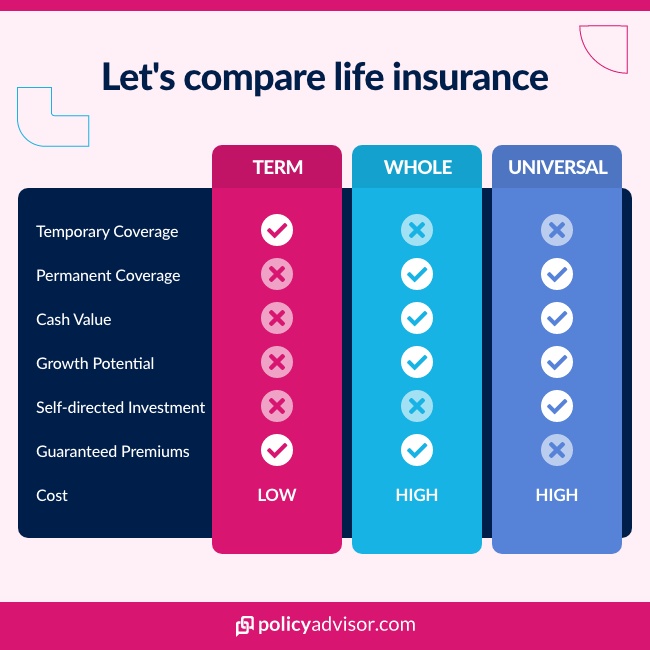

If you decrease how much you spend on premiums, the difference is taken out from your plan's cash money worth - Annuities in Toccoa, GA.A global policy can be more expensive and complex than a typical entire life plan, particularly as you age as well as your premiums enhance (https://www.awwwards.com/jstinsurance1/). Best for: High income earners that are trying to develop a savings without going into a higher earnings brace. How it works: Universal life insurance policy allows you to change your costs and also death advantage depending upon your demands.

5 Easy Facts About Thomas Insurance Advisors Described

Pro: Gains prospective variable policies may gain more passion than typical entire life. Disadvantage: Investment danger possibility for losing money if the funds you picked underperform. Final expense insurance coverage, also known as funeral insurance coverage, is a sort of life insurance policy created to pay a small survivor benefit to your family to help cover end-of-life expenditures.

Because of its high prices and also reduced insurance coverage amounts, final expenditure insurance is normally not as great a worth as term life insurance policy. Just how it works: Unlike a lot of traditional policies that need a clinical test, you only need to respond to a couple of questions to qualify for final expense insurance policy.

Thomas Insurance Advisors - The Facts

Pro: Guaranteed coverage easy access to a small benefit to cover end-of-life expenses, including medical expenses, burial or cremation services, and also coffins or containers. Con: Expense pricey premiums for lower coverage amounts. The best way to choose the plan that's ideal for you is to talk with a monetary consultant as well as deal with an independent broker to discover the right policy for your particular needs.Term life insurance policy plans are normally the very best service for people that require inexpensive life insurance for a particular period in their life (https://medium.com/@jimthomas30577/about). If your objective is to supply a safety and security internet for your household if they needed to live without your earnings or contributions to the household, term life is likely a great suitable for you.

If you're currently making best use of payments to conventional tax-advantaged accounts like a 401(k) as well as Roth IRA and desire one more financial investment lorry, irreversible life insurance coverage could benefit you. Last expense insurance policy can be a choice for individuals that may not be able to get insured otherwise since of age or severe wellness problems, or elderly customers who don't intend to concern their households with funeral prices."The appropriate sort of life insurance policy for each person is entirely depending on their private circumstance," states Patrick Hanzel, a qualified economic organizer and also progressed preparation manager at Policygenius.

Some Known Facts About Thomas Insurance Advisors.

Much of these life insurance alternatives are subtypes of those featured over, meant to offer a particular objective, or they are defined by just how their application process additionally referred to as underwriting works - https://filesharingtalk.com/members/584715-jstinsurance1. By sort of coverage, By kind of underwriting Group life insurance policy, also called group term life insurance coverage, is one life insurance policy contract that covers a group of people.Team term life insurance policy is typically supported by the insurance policy holder (e. g., your company), so you pay little or none of the policy's premiums. You obtain protection up to a limit, typically $50,000 or one to 2 times your annual salary. Team life insurance is inexpensive as well as simple to get approved for, yet it rarely supplies the degree of protection you could need and you'll most likely shed coverage if you leave your task.

Best for: Any person that's provided team life insurance by their company. Pro: Convenience team policies give assured protection at little or no cost to employees. Con: Limited insurance coverage and also you normally lose protection if you leave your employer. Mortgage protection insurance coverage, also referred to as MPI, is developed to pay off your continuing to be home loan when you die.

The Definitive Guide for Thomas Insurance Advisors

With an MPI policy, the recipient is the home loan firm or lender, instead of your household, and also the survivor benefit reduces with time as you make home mortgage settlements, similar to a decreasing term life insurance policy plan. For the most part, buying a conventional term plan instead is a better selection. Best for: Any individual with home loan obligations who's not qualified for standard life insurance policy.Con: Limited protection it just protects mortgage payments. Credit life insurance policy is a kind of life insurance policy that pays out to like it a lending institution if you pass away prior to a funding is settled as opposed to paying out to your beneficiaries. The policy is linked to a solitary financial obligation, such as a home mortgage or company funding.

You're guaranteed approval and also, as you pay for your financing, the survivor benefit of your policy lowers. Final Expense in Toccoa, GA. If you pass away while the plan is in force, your insurance policy carrier pays the death benefit to your lending institution. Home loan defense insurance coverage (MPI) is one of one of the most common kinds of credit rating life insurance policy.

Report this wiki page